operating cash flow ratio ideal

Thus in this case the operating cash flow to sales ratio must be 75 or close. This is especially beneficial when the companys profits are currently quite low on certain items.

Cash Flow Formula How To Calculate Cash Flow With Examples

However there are no ideal cash turnover ratios This is because different companies have different operating styles.

. In the next 12 months Walmart generated 278 billion in operating cash flow whereas Target generated 6 billion. Cash flow from operations refers to the magnitude of cash flows that the business generated from operations during the accounting period. However they have current liabilities of 120000.

If it is higher the company generates more cash than it needs to pay off current liabilities. What does a cash turnover ratio show you. Operating cash flow ratio CFO Current liabilities.

Operating cash flow ratio 140000 100000. 250000 120000 208. Since these figures are so close we can say that Walmart and Target have similar liquidity.

This is a simple enough ideawith powerful results. Thus the operating cash flow ratio for Walmart is 036 whereas Targets is 034. An Operating Cash Flow Ratio is an accounting ratio that shows the amount a company uses for ongoing operations divided by its operating cash flow adjusted for non-recurring itemsThe Operating Cash Flow.

A ratio smaller than 10 means that your business spends more than it makes from operations. This ratio calculates how much cash a business makes as a result of sales. If the ratio is more than 1 it infers that the firm has more cash to pay off its liabilities due within a year.

The operating cash flow ratio is different from the current liability coverage ratio in only. Operating Cash Flow Ratio. Cash flow from operations appears to be more favorable than net income because of lesser possibility of.

Lets take each component individually to understand what number needs to be plugged in. The cash turnover ratio shows you how many times the company can make a complete cycle of cash flow. 5 Ratios for Cash Flow Analysis Current Liability Coverage Ratio.

Operating cash flow Net cash from operations Current liabilities. Operating Cash Flow Ratio. Operating cash flow is a measure of the amount of cash generated by a companys normal business operations.

The operating cash flow OCF ratio is the measure of money earned and spent by your business. Operating cash flow ratio 14. Operating Cash Flow.

Operating cash flow is the cash generated through a. Revenue from operations Non-cash based expenses Non-cash based revenue Current Liabilities. For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time.

Operating Cash Flow Ratio Operating cash flow Current Liabilities¹ ². The operating cash flow. This may signal a need for more capital.

The operating cash flow ratio is a measure of a companys liquidity. The ideal ratio is close to one. You can work out the operating cash flow ratio like so.

Operating Cash Flow - OCF. Operating cash flow indicates whether a company is able to. Operating cash flow ratio operating cash flow current liabilities.

This is because it shows a better ability to cover current liabilities using the money generated in the same period. By using the formula the financial analyst finds that the company has an operating cash flow ratio of 14. Example of Operating Cash Flow Ratio.

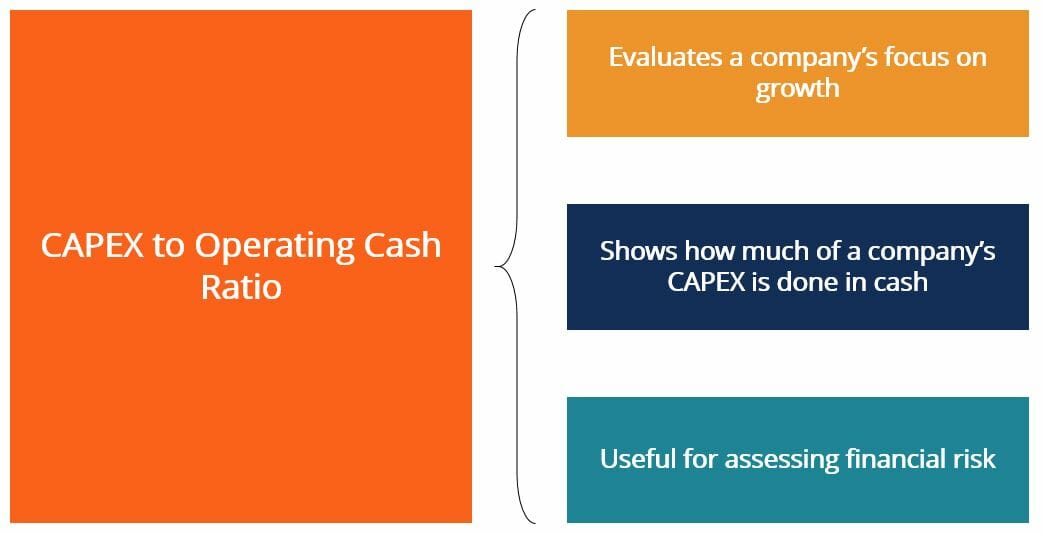

Cash Flow From Operations. This means that Company A earns 208 from operating activities per every 1 of current liabilities. The CAPEX to Operating Cash Ratio is calculated by dividing a companys cash flow from operations by its capital expenditures.

Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you make. A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate. Ideally a good cash turnover ratio is one that gets smaller depending on the company.

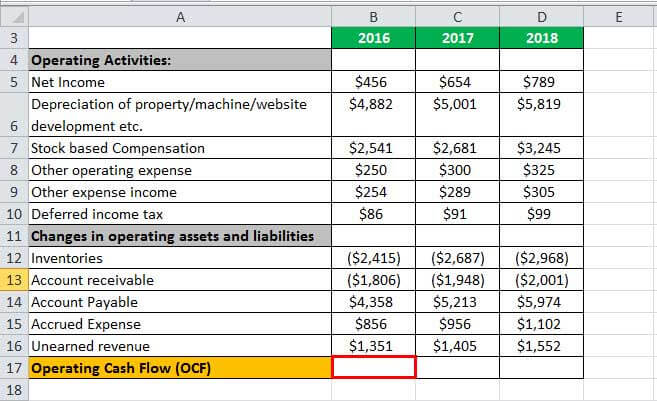

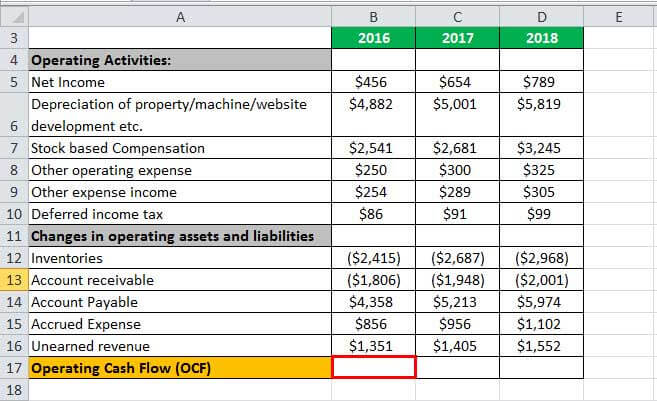

Essentially Company A can cover their current liabilities 208x over. Doing so simplifies the companys product line making it easier to run the company. From the below details of Unreal corporation calculate their.

Cash Interest Coverage. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. The higher the number is the more your business is making.

A cash flow coverage ratio of 138 means the companys operating cash flow is 138 times more than its total. It might seem that a smaller business wouldnt need to use. Operating cash flow ratio.

Selectively raise prices on the goods and services being sold. The OCF ratio lets you know if you are prepared to cover your expenses and how much cash you have on hand for any short-term needs. The operating cash flow ratio is a tool to measure how effectively cash flows from operations can cover current liabilities.

Thus investors and analysts typically prefer higher operating cash flow ratios. It includes Creditors BP Accrued Expenses Provisions Short-Term Loans etc. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

The formula to calculate the ratio is as follows. Operating Cash Flow Ratio is a key metric for success as a business to measure how much cash a company brings in from assets compared to how much it invests in assets. A higher ratio is more desirable.

In this case the retail company would have a cash flow coverage ratio of 138. Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth. Formula to Calculate Operating Cash Flow Ratio.

This ratio indicates the ability the businesss operations have to generate cash that. Now that a definition has been established its time to look at how to calculate operating cash flow ratio. If customers do not accept the higher prices then drop the products entirely.

This makes the analysts more sure that the financial statements of the firm are indeed genuine. We can apply the values to our variables and calculate the cash flow coverage ratio using the formula. Because this value is greater than one it indicates that the company has enough cash.

Operating Cash Flow Formula Calculation With Examples

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Cash Flow Formula How To Calculate Cash Flow With Examples

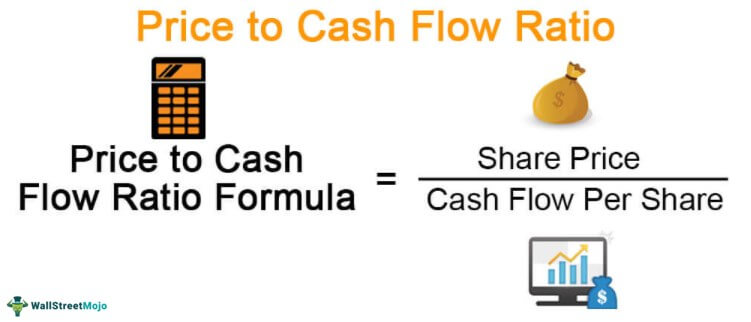

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Ratio Definition Formula Example

Price To Cash Flow Formula Example Calculate P Cf Ratio

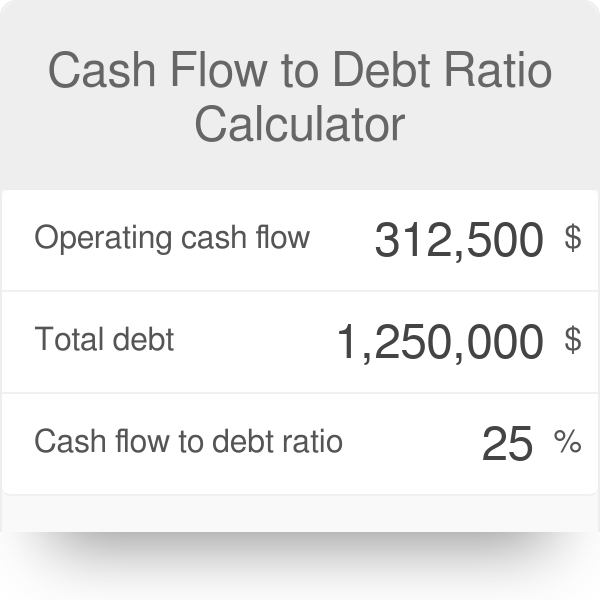

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow To Debt Ratio Calculator

Capex To Operating Cash Ratio Definition Example Corporate Finance Institute

Price To Cash Flow Ratio P Cf Formula And Calculation

Operating Cash Flow Efinancemanagement Com

Operating Cash Flow Formula Calculation With Examples

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Ratio Calculator